BOSS Wallet teaches you how to get a Bitcoin wallet

Summary: You need a Bitcoin wallet to store your bitcoin and to interact with DeFi on the Bitcoin blockchain. BOSS Wallet offers a convenient multi-chain solution to store your BTC, with planned support for the wider ecosystem.

Key Takeaways

● Bitcoin wallets are used to store BTC, and may support other assets on the Bitcoin blockchain like BRC-20 tokens.

● When choosing a Bitcoin Wallet, ensure that the wallet you have selected matches your requirements, which may include support for BRC-20 and DeFi, or storing multi-chain assets.

● BOSS Wallet provides you a secure platform to store your bitcoin alongside other cryptocurrencies from different chains, with plans to provide extensive support for the Bitcoin blockchain and its ecosystem in the future.

What Are Bitcoin Wallets?

Bitcoin wallets are used to store bitcoin (BTC), proving the holder’s ownership of any tokens within the wallet and enabling users to send and receive bitcoin. Some Bitcoin wallets also support other assets on the Bitcoin blockchain, such as BRC-20 tokens. BRC-20 tokens are Bitcoin’s equivalent of ERC-20 tokens using the Ordinals protocol. If you’re intending to use your Bitcoin wallet to explore the larger Bitcoin ecosystem, you want to make sure your wallet is able to connect to Bitcoin DeFi platforms.

Decentralized Finance (DeFi) is a key area of crypto, which focuses on offering financial instruments without requiring an intermediary like an exchange such as Binance. Instead, it lets users lend, borrow, swap, and provide liquidity by using smart contracts on a blockchain. The applications that enable users to participate in DeFi are called dApps.

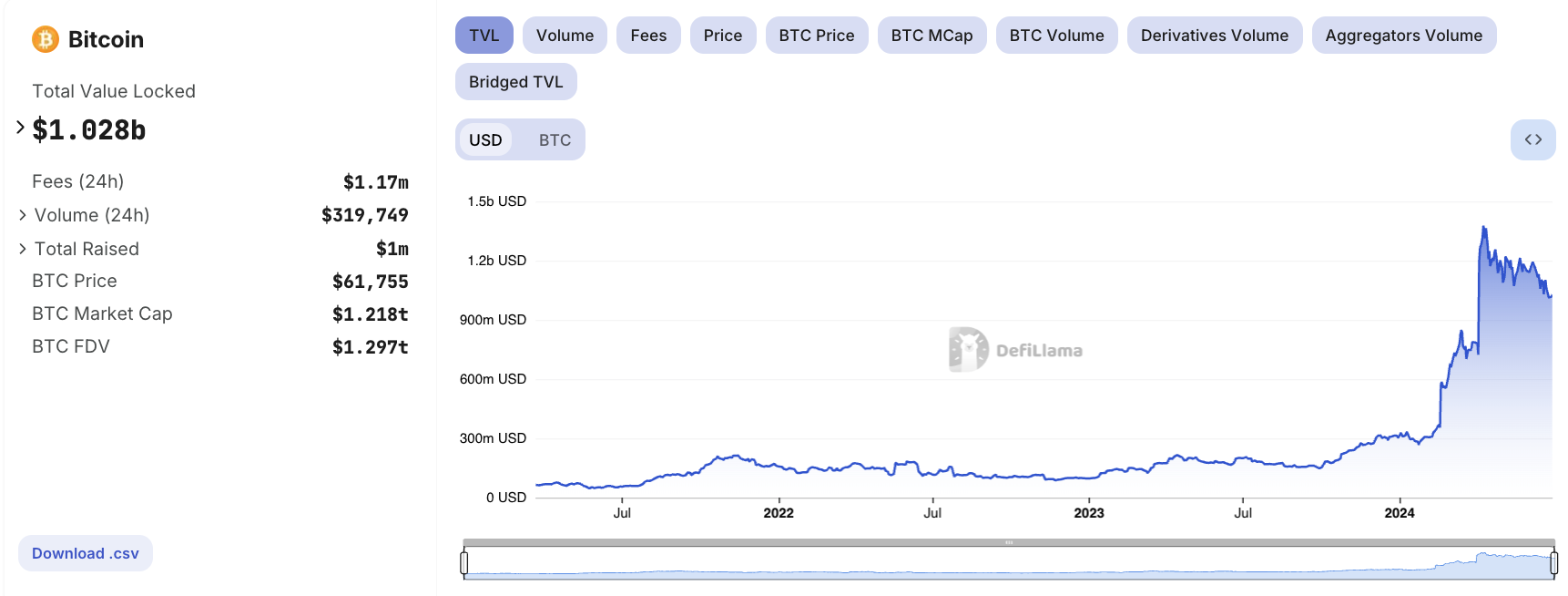

DeFi is a growing part of the Bitcoin ecosystem, with new Layer 2s on Bitcoin overcoming the limitations of smart contracts on the original Bitcoin network. Layer 2s are protocols built on Bitcoin to improve scalability, supporting more complex smart contracts while offering faster and cheaper transactions by conducting transactions off-chain, before these are sent to the Bitcoin blockchain for settlement. Julian Love, an analyst at Franklin Templeton Digital Assets,foresees potential for DeFi on Bitcoin, especially as fungible tokens on the blockchain take off.

“Whereas Ethereum, Solana and next-gen blockchains compete on the merits of their respective technologies, DeFi on Bitcoin is purely focused on increasing the productivity of bitcoin, placing the Bitcoin DeFi ecosystem in a league of its own.”

Bitcoin wallets are also used to interact with dApps on the Bitcoin blockchain, a space with currently over $1 billion in total value locked (TVL) according to DefiLlama. These can range from yield farms, decentralized exchanges (DEXs), lending, and payments, where users can deposit and swap BTC for other supported assets.

Types of Bitcoin Wallets

There are two broad types of crypto wallets: hot or cold wallets.

Hot Wallets

Hot (software) wallets are crypto wallets connected to the internet and are more accessible, offering users an easy way to trade and make purchases with crypto. Hot wallets are secured with a private key and an accompanying secret recovery phrase, which authorizes the holder to access the wallet and all its contents. Most hot wallet applications allow users to create and manage multiple hot wallets, which can be used for different purposes. However, every new wallet created usually comes with its own private key and secret recovery phrase, which can make managing multiple wallets tricky.

Cold Wallets

Cold (hardware) wallets offer an added layer of security by requiring physical possession of the cold wallet device in order to access the wallet’s contents, where your private keys never leave the device. Most cold wallets can also hold a range of cryptocurrencies across different blockchains. However, there are also additional steps around transacting with a cold wallet, making them more suited for long-term crypto storage. Cold wallets also tend to cost more, between $50 and $200.

Most users end up using a combination of both hot and cold wallets; a hot wallet for swaps and other DeFi interactions, and a cold wallet for long-term storage.

How to Choose a Bitcoin Wallet

When choosing a Bitcoin wallet, users need to consider what their main objective of using the wallet is.

BRC-20 Support

Are you looking for a wallet that supports newer Bitcoin token standards like BRC-20, on top of bitcoin? If you are, it’s important to choose a wallet that plans to extensively support these token standards, as most popular existing multi-chain Bitcoin wallets have limited support for these token types.

Active Trading on Bitcoin DeFi

As mentioned above, most popular wallets have limited support for other Bitcoin token standards, only allowing users to send and receive BRC-20 tokens, with no option to swap these for other tokens, or connect to dApps on Bitcoin.

While the current version of BOSS Wallet does not support the Bitcoin ecosystem, the next version will be compatible with the Bitcoin ecosystem, allowing users to store and swap their BRC-20 tokens, even opening the possibility of cross-chain swaps through BOSS Wallet’s internal AMM Swap feature.

Storing Multi-Chain Assets

While most hot wallets support multiple chains, some may be chain or virtual machine specific, like how MetaMask only supports EVM chains. So when choosing a wallet to store your Bitcoin assets, it’s important to make sure that you consider other assets you’ll be storing in your wallet. Do take note that some multi-chain hot wallets require the creation of a new wallet with a different private key or secret recovery phrase for every supported chain, where users need to carefully store and manage multiple secret recovery phrases.

If you are intending to manage assets across multiple chains beyond Bitcoin, and will be creating multiple wallets for different purposes, such as interacting with DeFi, airdrop farming, and more, BOSS Wallet is designed for you. BOSS Wallet is a multi-chain wallet for storing your crypto assets, where you can manage multiple wallets with just one secret recovery phrase.

Long-Term Holding

For users who are intending to hold Bitcoin in the long term, it’s recommended that they use a separate wallet to minimize the risks of having their private key compromised. This wallet should not be connected to dApps to protect its contents in the event of a security breach. However, there’s also the risk of users forgetting their private keys, especially when it comes to bitcoins stored for long term investments.

Of the existing 19.7 million bitcoins in circulation, Chainalysisreports that 20% of these haven’t moved from their current set of addresses in five years or more and considers these bitcoins lost. 7002 of these bitcoins belong to Stefan Thomas, former CTO of Ripple, who lost the paper where he wrote the password for his hardware wallet, which gives users only 10 guesses before it encrypts its contents forever — at time of writing, he has 2 more guesses to go.

With BOSS Wallet, you can minimize the risk of losing your crypto as you only need one secret recovery phrase to manage all your wallets. You can still enjoy the security of having a separate wallet with a separate private key, without needing to worry about memorizing or safely storing multiple secret recovery phrases.

How to Store Bitcoin With BOSS Wallet

You can store bitcoin on BOSS Wallet by either creating a new wallet on the platform and transferring your assets, or by importing an existing wallet.

To create a new wallet, select Create a New Wallet and create a six-digit PIN before safely recording and storing your secret recovery phrase, ideally offline and on crypto steel.

Once you’re done with creating your wallet, you can select Bitcoin and click Receive on the token page. This opens up your Bitcoin address on BOSS Wallet and its corresponding QR code. You can now transfer your BTC to your BOSS Wallet.

Alternatively, you can also import an existing Bitcoin wallet by entering your secret recovery phrase or private key. Once you have entered your private key or secret recovery phrase, all your assets will now be ported to your BOSS Wallet.

Bitcoin Assets Supported On BOSS Wallet

At time of writing, the only Bitcoin asset supported on BOSS Wallet is bitcoin (BTC). However, the team has plans to release an update soon, after which BRC-20, ARC-20, and other tokens within the Bitcoin ecosystem will be supported on BOSS Wallet.

Benefits of BOSS Wallet

Multi-Currency, Multi-Chain Wallet

BOSS Wallet is a multi-currency, multi-chain wallet that lets users manage all their accounts on the same platform, while making it easy to explore new chains. BOSS Wallet is also working towards cross-chain functionalities and improving the interoperability between chains. Unlike incumbents like MetaMask, which only supports EVM chains with limited interoperability outside the EVM, BOSS Wallet will let users manage cryptocurrencies across over 90 supported chains, and even swap them on its inbuilt DEX.

Gas Pool

In order to interact with a blockchain, you’ll need some of the chain’s native token to pay for gas fees. On most existing wallets, including industry leaders like Trust Wallet, MetaMask and Coinbase, you’ll need to figure out how to acquire these native tokens before you can start exploring the capabilities of a new chain. To acquire these native tokens, you usually have to either purchase these on a centralized exchange, bridge and/or swap assets from a different chain, or receive donations from friends and acquaintances.

With BOSS Wallet, you can now deposit any supported cryptocurrency into a multi-chain gas pool, which will be used to cover transactions on any of BOSS Wallet’s supported 90 chains. BOSS Wallet will also be introducing zero gas rights, which can be used to offset gas fees for registered users when they transact using BOSS Wallet.

Easy Account Management

BOSS Wallet uses the BIP44 standard, enabling users to use one secret recovery phrase to manage all assets on the platform, regardless of chain. This secret recovery phrase, which is generated when users first create their BOSS Wallet account, can be used to generate multiple wallet addresses for all supporting chains based on their standards.

Also, BOSS Wallet removes the complexity of blockchain operations, where users don’t need to learn about signing transactions; instead, to approve transactions, theyjust have to enter their PIN.

BOSS Wallet also offers users a payment confirmation mechanism in the form of BOSS ID. When enabled, senders must verify the BOSS ID after entering the recipient address, ensuring that the assets will be sent to the correct recipient. Do note that usage of this feature is not compulsory; users can enable and disable payment verification as needed.

Interact With the Bitcoin Ecosystem (Coming Soon)

BOSS Wallet is planning to support the Bitcoin ecosystem, enabling users to connect to Bitcoin DeFi apps across yield farms, payments, DEXs, and lending. BOSS Wallet will also support BRC-20, allowing users to manage, transfer and swap these tokens for other supported assets within BOSS Wallet Swap.

In the future, BOSS Wallet will also support ARC-20, which are also fungible tokens on Bitcoin which link to satoshis and based on the Atomicals protocol (unlike BRC-20, which are inscribed on satoshis and based on the Ordinals protocol). There are also plans to support other Bitcoin-based tokens from scaling solutions like RSK, Stacks, RGB, BitVM, and the Lightning Network.

Conclusion

When choosing a Bitcoin Wallet, it is important to consider your primary intent: Are you looking for a multi-chain wallet that lets you manage multiple assets across multiple chains, along with multiple wallets for different purposes, easily on one platform? Or are you looking for a wallet with extensive support for the Bitcoin ecosystem, enabling you to manage and swap your BTC and BRC-20 tokens?

BOSS Wallet offers you the best of both worlds; right now, you can already manage your assets across different chains, including Bitcoin, on BOSS Wallet. In the future, BOSS Wallet will also support the Bitcoin ecosystem, making it easy for you to explore the Bitcoin DeFi space.

This article is only for education and information purposes, and should not be taken as financial advice. Always do your own research before using any crypto protocols, and always store your secret recovery phrase securely offline.

(1).png)

本文精华如下:

本文精华如下:

.png)